NEWS ANNOUNCEMENT

Good Signing ≠ Good Business: A Look at Two Recent Transfers…

In an eye-catching summer of transfers, two clubs have made very different investments – not just in talent, but in value, strategy, and long-term benefit. While both signings may look good on paper, only one may make better business sense.

The Deals

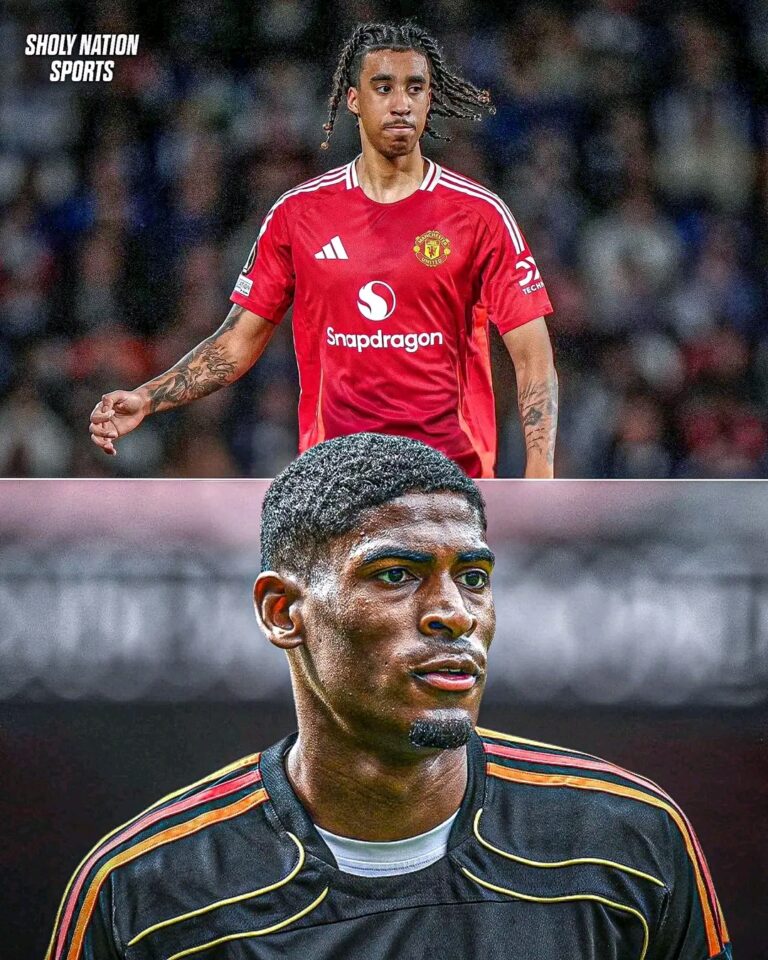

- Manchester United have reportedly agreed to pay €70 million for Leny Yoro. He joins on a deal which gives him an estimated €180,000 per week in wages.

- Arsenal, meanwhile, have shelled out €15 million for Cristhian Mosquera, offering approximately €60,000 per week.

Good Signing vs. Good Business

What separates a “good signing” from “good business” in football? The two transfers highlight the difference.

1. Talent vs. Cost

- Leny Yoro is young, highly rated, and seen as having world-class potential. The size of the transfer fee and the wage suggest United view him as a long-term investment and possibly a future pillar at centre-back.

- Cristhian Mosquera is also young, promising, and with his own upside. Arsenal’s investment is more modest. The fee is lower, the wage offer is more conservative – less risk if he doesn’t develop as expected.

2. Risk Exposure

- When you pay €70 million and €180,000/week, you’re exposed to multiple risks: injuries, adaptation issues, fluctuations in form, possible resale complications. The higher the cost, the more margin for loss.

- Arsenal’s €15 million / €60,000 per week risk is much lower. Even if Mosquera doesn’t become a superstar, the financial hit will be far smaller. The club has more room to be wrong without it damaging their books or expectations irreparably.

3. Expectations & Pressure

- High fees bring high expectations. Yoro will likely be expected to contribute quickly and justify his salary and transfer fee. That can lead to pressure, less patience, and potentially a mismatch between development trajectory and fan demands.

- Mosquera can develop with a potentially lower level of external pressure, perhaps allowing more patience and gradual integration. Arsenal may afford to allow mistakes without the kind of scrutiny that accompanies a seven-figure outlay.

4. Return on Investment

- For United, the ROI depends on how quickly Yoro can deliver top performances, whether he becomes a mainstay, whether resale value remains high, etc. If he fails to meet the lofty expectations, the “investment” may look less like business and more like risk.

- Arsenal’s transfer offers more chance that even if Mosquera doesn’t reach absolute elite level, he can be useful, developed, and possibly sold onward, all while minimizing losses. That’s good business.

⚖️ Verdict

Both clubs have their reasons. Manchester United are clearly investing heavily to compete immediately and secure potential long-term defensive stability. Arsenal are spending more conservatively, taking an educated gamble on youth.

Which is the better model? It depends on results. If Yoro becomes a world-class defender and helps United win titles or generate further transfer gains, then the high cost will look justified. If not, that money could be considered misallocated.

Similarly, if Mosquera develops well, perhaps becomes a solid starter or even improves in value, then Arsenal will look like they got very good value for investment ‒ less flashy, but smarter financially.

Conclusion

A “good signing” is about the player’s ability, potential, and fit. A “good business” is about the financial context, risks vs reward, and whether the cost matches the return.

In the case of Yoro, United may have done a great signing, but whether they did good business remains to be seen. With Mosquera, Arsenal may have structured their deal more conservatively, which often equates to better business if the upside materializes.

Final Thought: Transfer fees and wages grab headlines, but the truly successful clubs are those that balance ambition with prudence — signing well and doing good business.

(Word count: approx. 680)